As markets become more competitive and data-driven, finance functions are evolving from back-office operations into strategic drivers of growth. Modernizing finance is no longer just about upgrading systems—it’s about rethinking processes, improving insight, and enabling faster, smarter decision-making that supports long-term business success.

Moving Beyond Legacy Processes

Traditional finance functions often rely on manual workflows, spreadsheets, and disconnected systems. These approaches slow down reporting cycles, increase the risk of errors, and limit visibility into financial performance. As organizations grow, legacy processes struggle to keep pace with increased complexity.

Modern finance functions replace fragmented tools with integrated platforms that streamline close, reporting, planning, and forecasting activities.

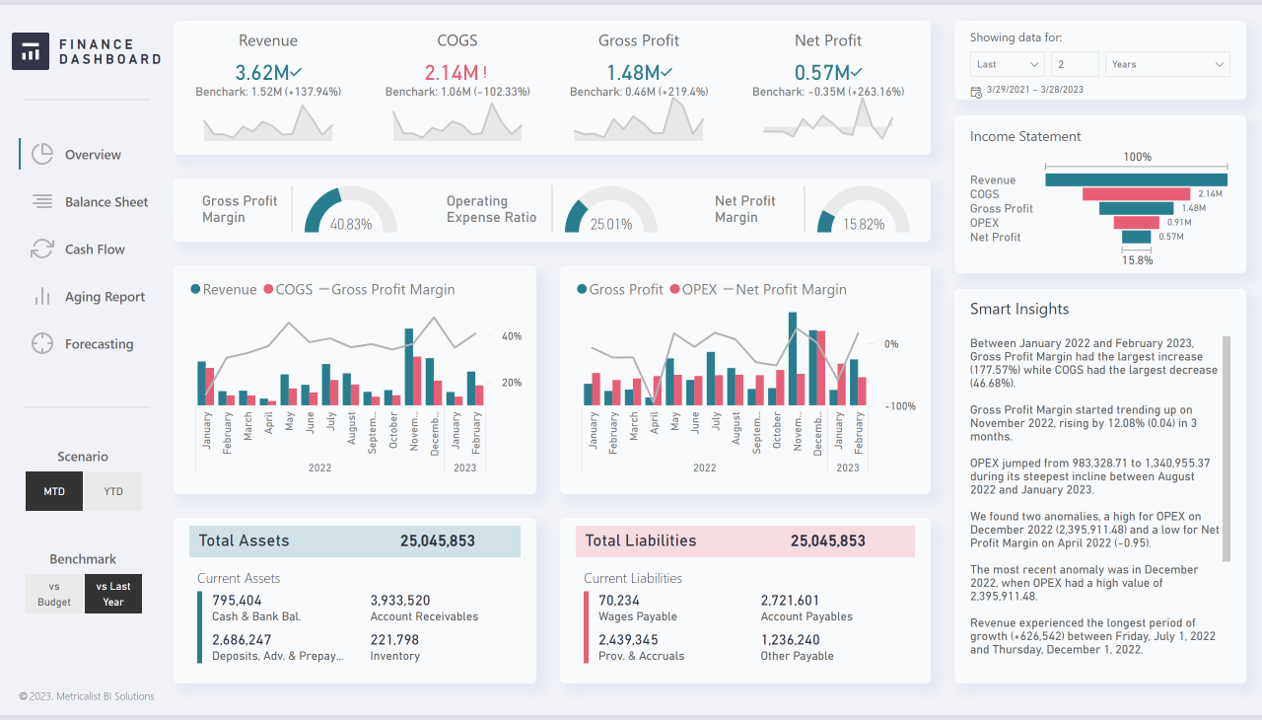

Improving Speed, Accuracy, and Insight

Modernization enables faster access to reliable financial data. Automation reduces manual effort and improves consistency, while real-time reporting provides leadership with timely insights. This shift allows finance teams to move beyond historical reporting and focus on forward-looking analysis.

With better data and analytics, organizations can respond more quickly to market changes and identify growth opportunities earlier.

Enabling Strategic Decision-Making

A modern finance function plays a central role in strategy. Scenario modeling, predictive forecasting, and performance analytics help leadership evaluate risks, allocate resources effectively, and align investments with long-term goals.

When finance is equipped with the right tools and processes, it becomes a trusted partner in shaping business direction rather than just reporting results.

Strengthening Governance and Scalability

As organizations expand, strong controls and scalable processes become critical. Modern finance systems support governance through standardized workflows, audit trails, and compliance-ready reporting. These capabilities reduce risk while making it easier to scale across regions, entities, and business units.

Scalability ensures that finance operations can grow alongside the business without repeated system overhauls.

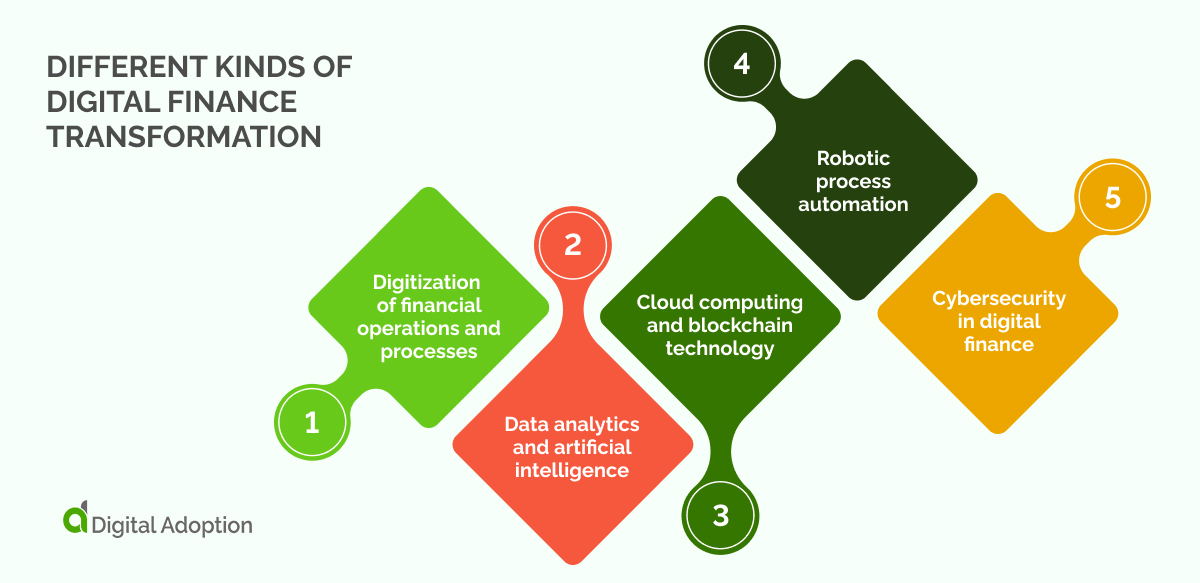

Supporting Change Through Expert Guidance

Modernizing finance often requires both technical and organizational change. Many organizations engage finance transformation services to help redesign processes, implement new technologies, and manage change across teams. Expert guidance helps ensure modernization efforts align with business objectives and deliver measurable value.

A structured approach increases adoption and accelerates time to impact.

Building a Future-Ready Finance Organization

Long-term growth depends on adaptability. Modern finance functions are designed to evolve, supporting new business models, regulatory requirements, and market conditions. By investing in people, processes, and technology, organizations build finance teams that are agile, insight-driven, and strategically aligned.

Conclusion

Modernizing finance functions is a critical step toward achieving sustainable, long-term growth. By replacing legacy processes with integrated systems, improving insight, and strengthening governance, organizations position finance as a strategic engine for value creation. A modern finance function doesn’t just support the business—it helps lead it into the future.